Investing when times are good is by and large simple. Investing when times are bad takes strategic discipline. Here’s a guest article by Matthew Benson, Owner of Sonmore Financial in Chandler, Arizona, and a Certified Financial Planner™ serving Arizona’s retirees and pre-retirees, aerospace business executives, and East Valley technology professionals. Matt specializes in tax-efficient investing, helping Sonmore’s clients maximize their retirement, college savings or donating to a worthy cause. Learn more about Sonmore Financial here, and read on below for more on what it takes to make market pullbacks work for you.

Short-term performance of markets is unpredictable. During those periods of time, one often needs to be reminded that your focus needs to be on controlling what you can control. Spoiler alert, the market isn’t one of them. The two simplest controllables are:

- a) How much risk you take on investing, and

b) How long you hold that investment.

In what follows, I will highlight four key strategies that can help you invest in a down market.

Dollar Cost Averaging/Ravaging – Many people are familiar with the concept of dollar cost averaging. This is simply having a periodic contribution that automatically occurs. This could be a biweekly contribution to your 401(k), a monthly contribution to your IRA, or a quarterly contribution to a non-retirement account.

When markets decline, investors’ initial reactions are rarely “thank goodness, what a great opportunity to buy.” However, having a disciplined investment strategy through periodic dollar cost averaging ensures that you continue to make purchases at better prices as the markets fall. This works very well for someone who is still in wealth accumulation mode.

For someone that is in the distribution phase of retirement, however, this works quite the opposite. Sometimes we call this dollar cost ravaging instead of dollar cost averaging. If you sell the positions that are declining the most then you are locking in those losses. When you’re in retirement, you need to have a disciplined distribution strategy. A strategy that has been shown to be effective is to take distributions in this order:

1) Take distributions from overweighted positions in the portfolio.

2) Take distributions from excess cash.

3) Take distributions from the more conservative pieces of the portfolio.

Maintaining a disciplined distribution strategy like this helps to mitigate the risk of market declines severely modifying your retirement plan.

Don’t Market Time – Nobody likes seeing negative returns on their portfolio. For even the most disciplined investor it can be challenging to resist selling when the markets decline. Fidelity has done a study that highlights the cost of missing the five best days in market. If you missed the 5 best days in the S&P 500 from 1980 through 2020, this would’ve cost you about 38% of your gains. If you had invested $10,000 at the beginning of 1980, by March 31, 2020, you would’ve had $697,421. If you had missed the 5 best days you would have ended up with $432,411, a difference of $265,010. The takeaway from this is to stay invested during market declines. As long-time Fidelity fund manager Peter Lynch was fond of saying: “Far more money has been lost by investors preparing for corrections, than has been lost in corrections themselves.”

View a summary of the study here: https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/dont-miss-best-days.pdf

Diversify & Don’t Chase Returns – Trying to invest in the latest fad can be very tempting. This can be particularly tempting during market declines. Often the asset classes that have declined the most are the biggest winners in the coming years while the most recent winner often underperforms in the immediate future. This can make sense because the values of those companies may have been driven up such that the underlying profits do not support the market price.

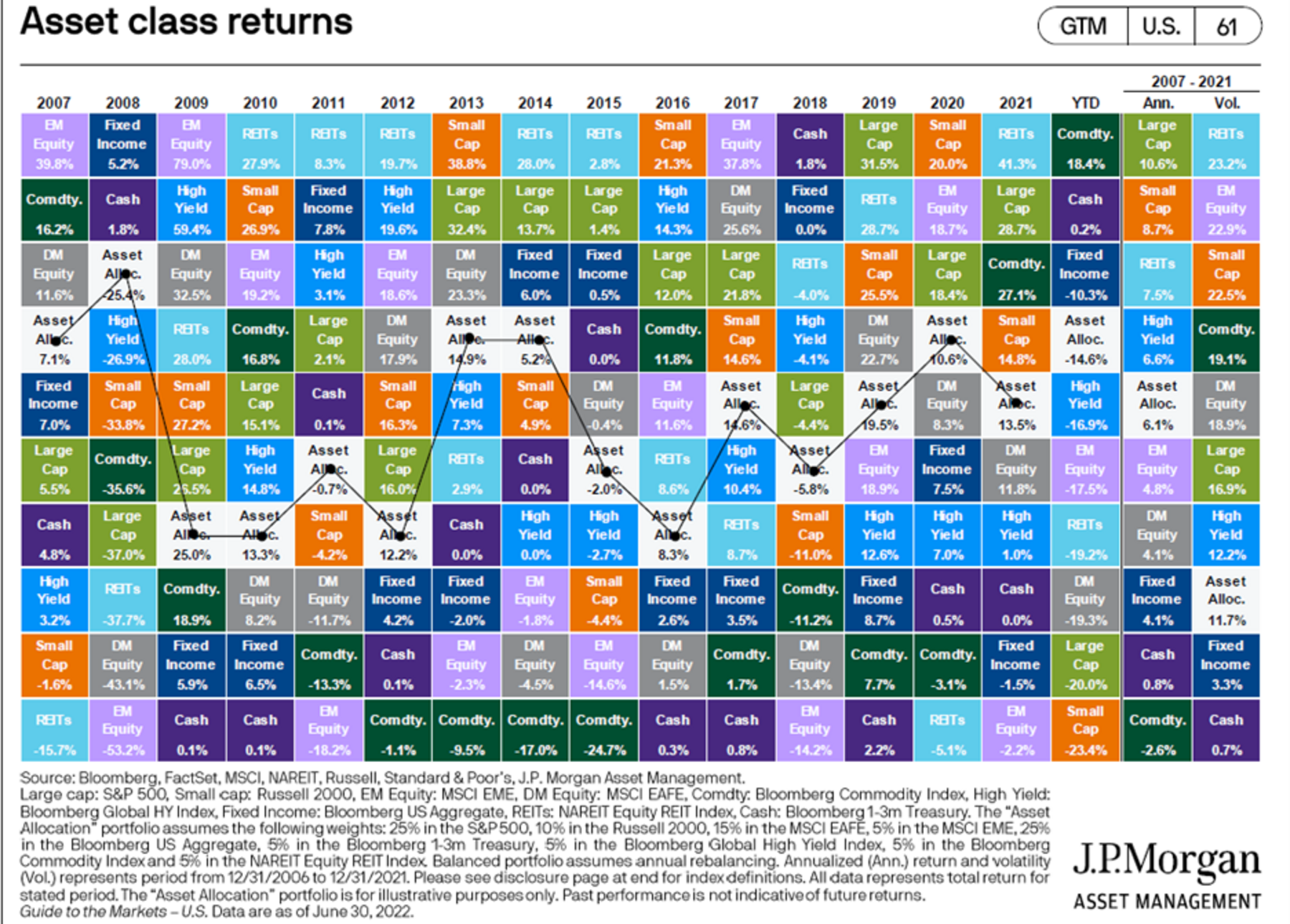

The chart below provided from JP Morgan’s quarterly guide to the markets highlights major asset class returns year-by-year since 2007. You can see it’s quite common that a good performer’s rank in one year is little-to-no indication of its performance in future years. This further supports the need for a diversified portfolio where you stay invested over the long term.

Valuations matter – Often it can feel like stock prices go up and down for no apparent reason. In the short term that can feel especially true. You might read a headline that says XYZ company has record sales, then watch their stock price go down on another point or vice versa.

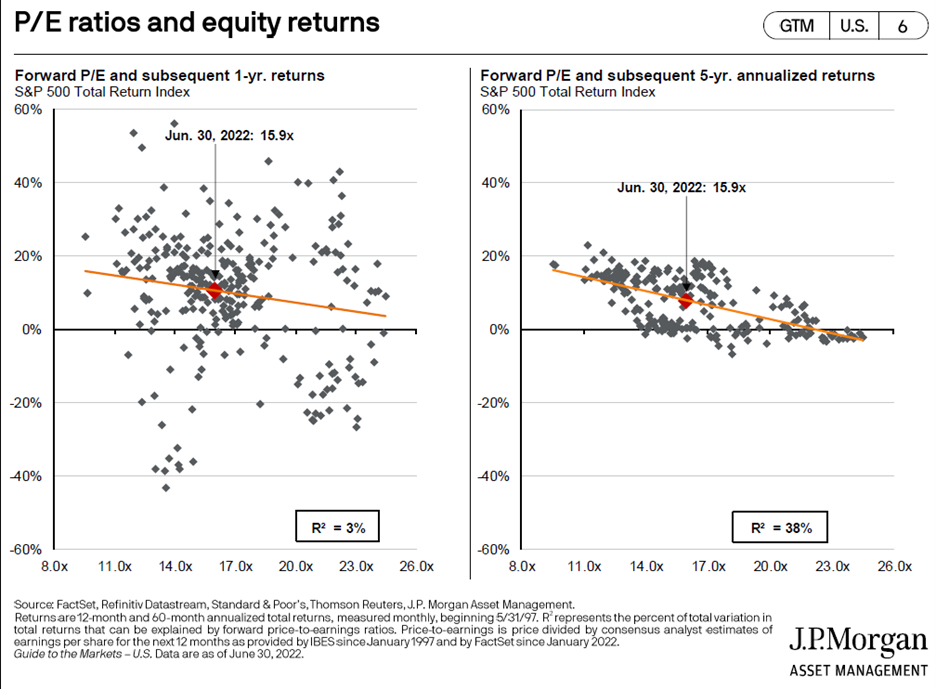

Over the long term, companies that are trading higher than their historic averages tend to come down and companies that are trading below their historic averages tend to go up. You can see this illustrated below in the one and five-year price-to-earnings (P/E) chart from JP Morgan’s guide to the markets. This chart monitors stock price relative to profit-per-share as opposed to simply monitoring stock price alone. During market declines you may consider having tilts in your portfolio to undervalued asset classes. Of course, this goes against your intuition as the assets that are generally undervalued have typically underperformed.

Investing and money are certainly an emotional battle. Being armed with some of the facts presented here can hopefully give you the confidence to have a disciplined investment strategy during market declines. The good news is that by practicing proper diversification, dollar cost averaging or strategically drawing down funds, staying invested over the long term, rebalancing based on risk profile and asset allocation, and harvesting tax losses, you can potentially have a more positive investment experience when stocks are down.

If you feel your investment plan is too important to be doing it by yourself, and you want to delegate the heavy lifting to an expert who can work directly with your CPAs and Accountants to maximize tax savings and retirement income, Sonmore Financial is here to help. We offer a no-obligation, no-cost second opinion here: https://sonmorefinancial.com/financial-planning-assessment/.

Important Disclosures

Sonmore Financial is a Registered Investment Advisor in the State of Arizona. Sonmore Financial and Fox Peterson are not affiliated. The entity and the third-party site are unaffiliated with Sonmore Financial, LLC. The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security.

Past performance is not indicative of future results. No client or prospective client should assume that future performance of any specific investment or investment strategy made reference to directly or indirectly by Sonmore Financial or indirectly via a link to a third-party website, will be profitable or equal any corresponding indicated performance levels. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable for a prospective client’s investment portfolio.